Solutions for Generative AI Trading Strategy Development

Employing aggregated alternative datasets and machine learning to predict trading signals is not new. However, recent evolutions in generative AI via massive LLMs and powerful processing hardware have rapidly evolved the speed and accuracy of identifying market patterns and trends that were previously overlooked.

The ability to access ever more powerful AI infrastructure, particularly cloud-based resources, has placed AI development capabilities into the hands of most firms, even smaller, independent traders. Further,

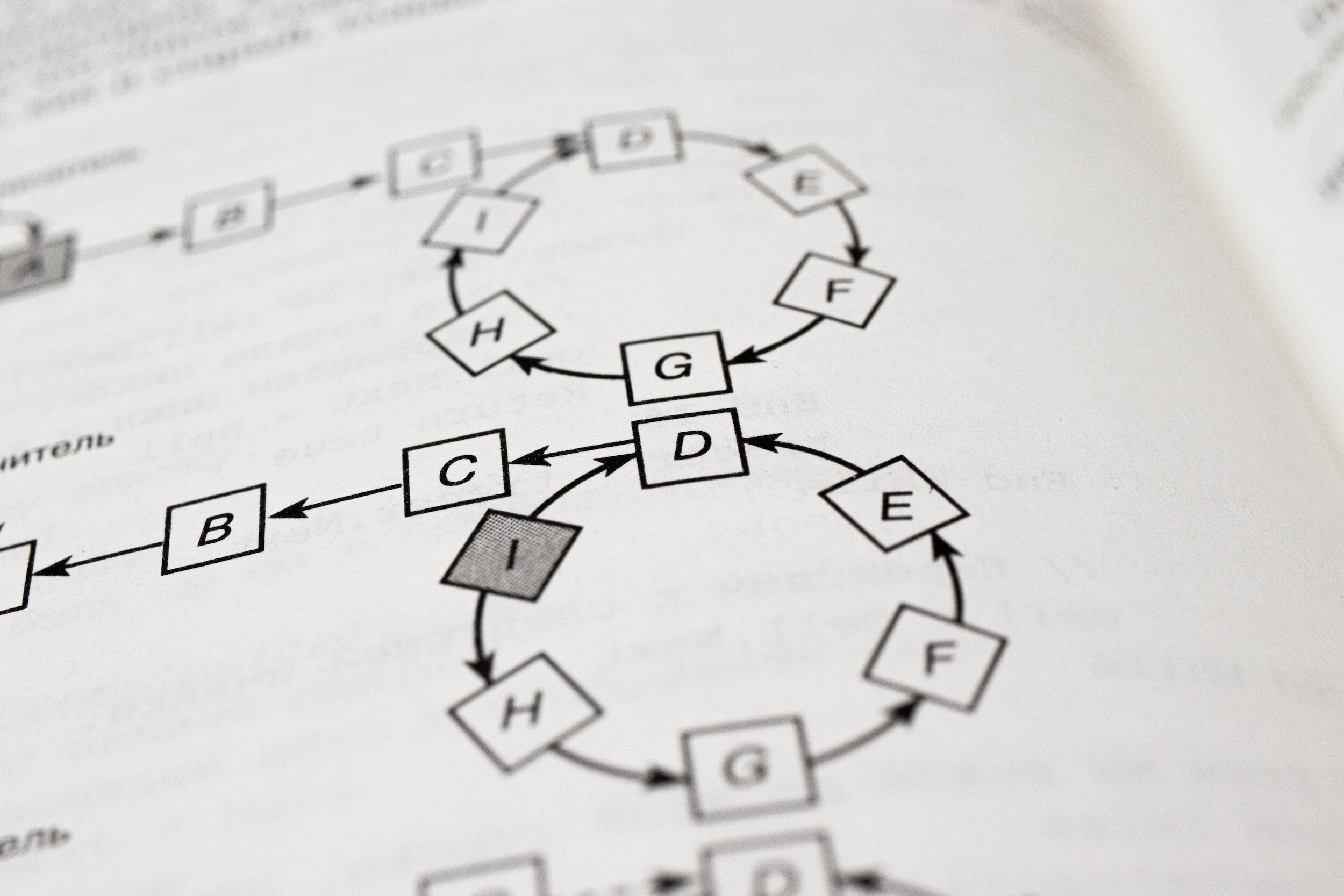

It is a well understood problem of market simulation…

…that signal identification and algorithmic strategy development does not automatically correlate with the ability of these strategies to execute successfully in markets. Evaluating trading algorithms as to their realism, determinism, and automated modification at pace remains a challenge that stands in the way for widespread confidence and acceptance (but not necessarily use) of fully or mostly autonomous AI trading algos.

AI is becoming more independent…

…as evolutionary algorithms use design frameworks that continuously optimize strategies automatically as black box systems (sans humans). The need for better execution training will only intensify

A lack of systematic execution testing…

is tempering the speed, confidence, and performance of newly emerging AI-generated algorithmic trading strategies. For AI platforms utilizing the vast resources of private clouds, legacy systems often are not easily migrated, lack cloud access, and are difficult to integrate with other legacy systems/processes.

AI models face an inability to iteratively train and assess execution success creates expectations that cannot be met in live markets, thus adding to the lack of confidence and acceptance of AI-generated trading strategies in the marketplace – impacting both alpha realization on millions/billions of dollars of trading revenues and financial markets investment in AI training and trading for cloud providers.

The confidence gap is something that Quantum is uniquely capable of solving via a cloud-based, fully-automated AI utility designed for AI toolsets to programmatically request, installed, run, and release multiple simultaneous Quantum platform instances deployed into their private cloud without any human intervention, on-demand.

Quantum Use Cases for Generative AI Automated Trading Strategies

-

Compelling Rationale

Developers of AI-generated strategies require quick deployment of identified strategies without compromising on depth and breadth of performance

The toolsets available to AI developers need fully-automated, programmable interfaces from which to automate testing

AI developers need a more accurate simulation of a complex multi-venue market environment to understand likely performance under realistic conditions

AI developers need to ensure that AI-created algorithm’s behaviors are well understood in realistic edge case scenarios to avoid deploying costly errors or fine-generating regulatory debacles

Key Quantum Functionality:

Quantum provides fully automated programmable interface AI tools need for fully automated testing and test data collection

Quantum offers multiple interactive venues, simultaneous testing instances, and the realism, determinism, venue routing and range of order types required by sophisticated clients

Quantum provides easily configurable market data scenarios, tuned to each client and each user

Quantum’s proprietary agent framework also allow AI tools to avoid building and testing a full complement of exchange gateways or broker trading stacks to test orders and receive market data

Quantum users can Iterate algorithm parameters in parallel via multiple simultaneous instances

Quantum provides on-demand, earlier access to market data scenarios, allowing developers to access historical market data feeds and create synthetic market data feeds from customizable scenarios

Use Cases delivered by Quantum:

Market signal research with simultaneous testing instances

Edge case behavior identification

Performance optimization testing

-

Compelling Rationale

Need a more accurate simulation of a complex multi-venue execution environment to understand likely performance under realistic conditions

Need to ensure that AI-created algorithm’s behaviors are well understood under edge case scenarios to avoid deploying costly errors or fine-generating regulatory debacles

Require quick deployment of identified strategies without compromising on depth and breadth of performance and regulatory testing

Key Quantum Functionality:

Quantum offers multiple interactive venues, simultaneous testing instances, and the realism, determinism, venue routing and range of order types required by sophisticated clients

Quantum provides easily configurable market data scenarios, tuned to each client and each user

Quantum’s proprietary agent framework also allow AI tools to avoid building and testing a full complement of exchange gateways or broker trading stacks to test orders and receive market data

Quantum users can Iterate algorithm parameters in parallel via multiple simultaneous instances

Quantum provides on-demand, earlier access to market data scenarios, both historical and synthetic

Speed algo to market by moving model validation & compliance checks upstream

Use Cases delivered by Quantum:

Market signal research with simultaneous testing instances

Edge case behavior identification

Performance optimization testing

Execution optimization testing

Operational scenario testing